Tax

Set up your tax rates and types and configure their appearance on the front end.

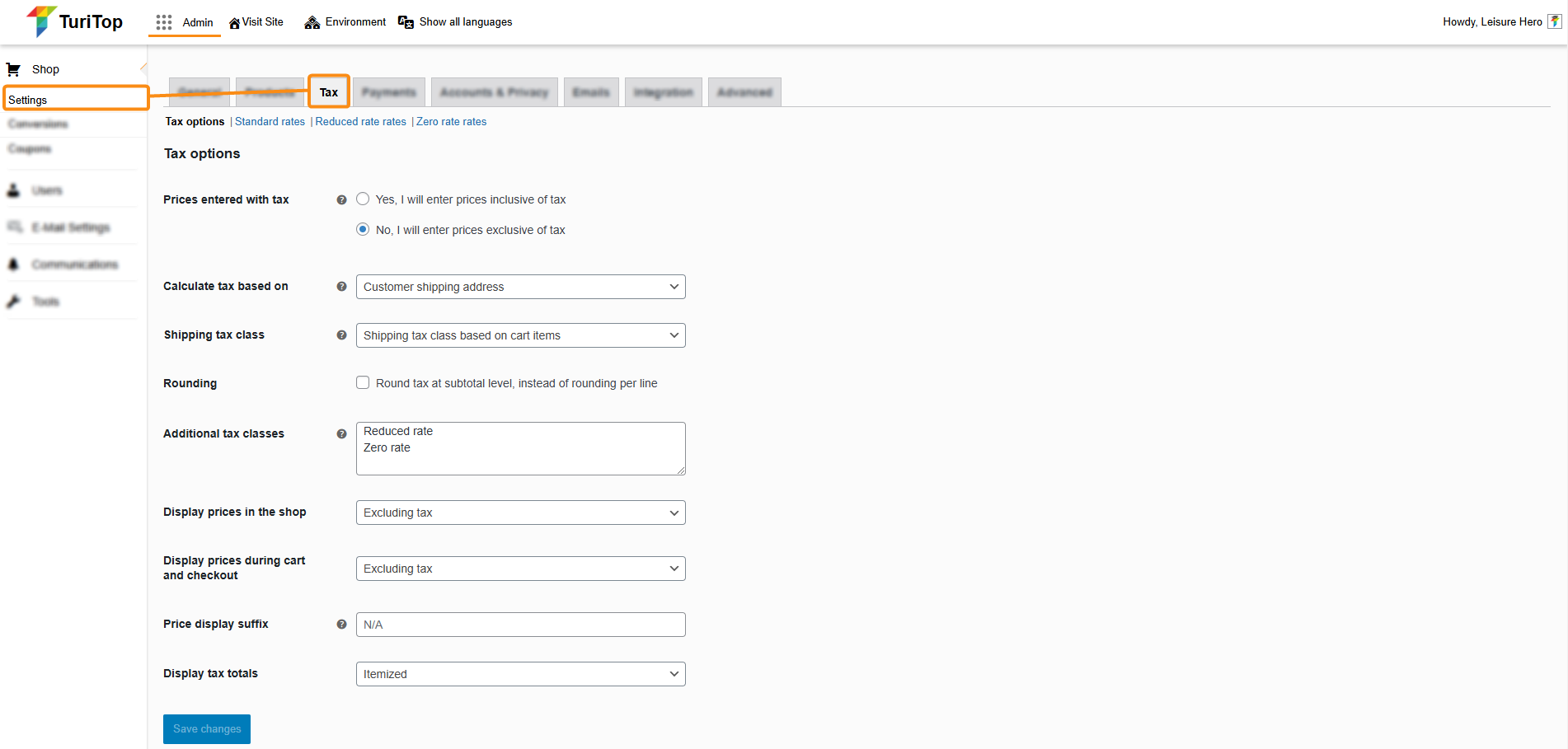

Admin >>> Shop >>> Settings >>> Tax

To view this section (Tax), you need to activate “Enable tax rates and calculations” in the General settings tab.

Tax options

In the first screen of this section, you can set up your store’s general tax options, including how taxes are calculated, displayed, and configured for various scenarios.

Key parameters:

- Prices entered with tax: Enable this option if your products’ prices include taxes.

- Calculate tax based on: Choose whether taxes will be calculated on the Customer Billing Address, Customer Shipping Address, or your Shop Base Address.

- Shipping tax class: For products requiring shipping, configure a specific tax rate or select an option to base the tax on the cart items.

- Rounding: Check this option to round tax at the subtotal level instead of rounding each line item.

- Additional tax classes: You may add here any additional tax classes needed (e.g., Reduced Rate, Zero Rate). Once you press the “Save Changes” button, these classes will appear under the Tax tab for further configuration.

- Display options: The last options are related to how you display the taxes on the front end. More specifically in the Shop, the Shopping Cart, and the Checkout pages. You can also add a suffix (ie. “inc. VAT”) and choose whether to display tax totals Itemized or as a Single Total.

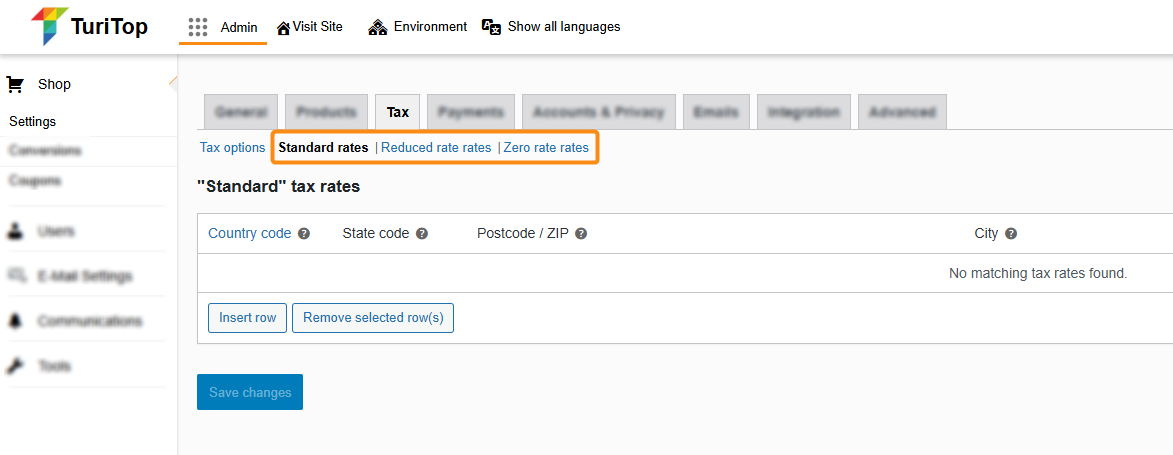

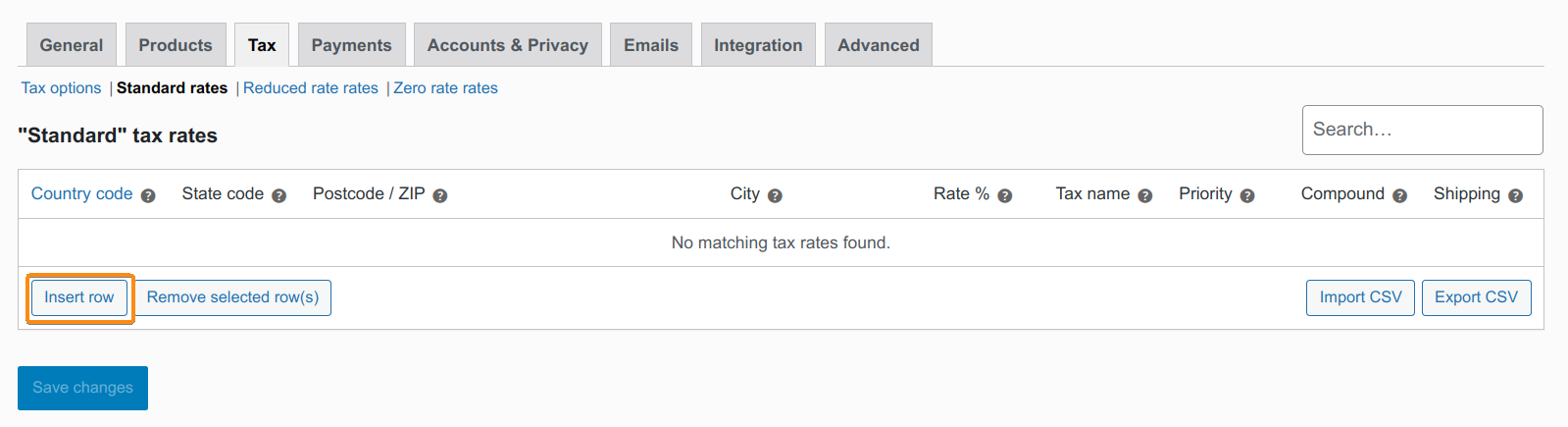

Configure Tax Rates

By default, you will have three types of Tax Rates: Standard Rate, Reduced Rate, and Zero Rate. Each one of them can be configured separately by clicking on the links below the Tax tab. You can also add as many classes as you want (see Tax options).

To configure a rate, click on the button Insert row.

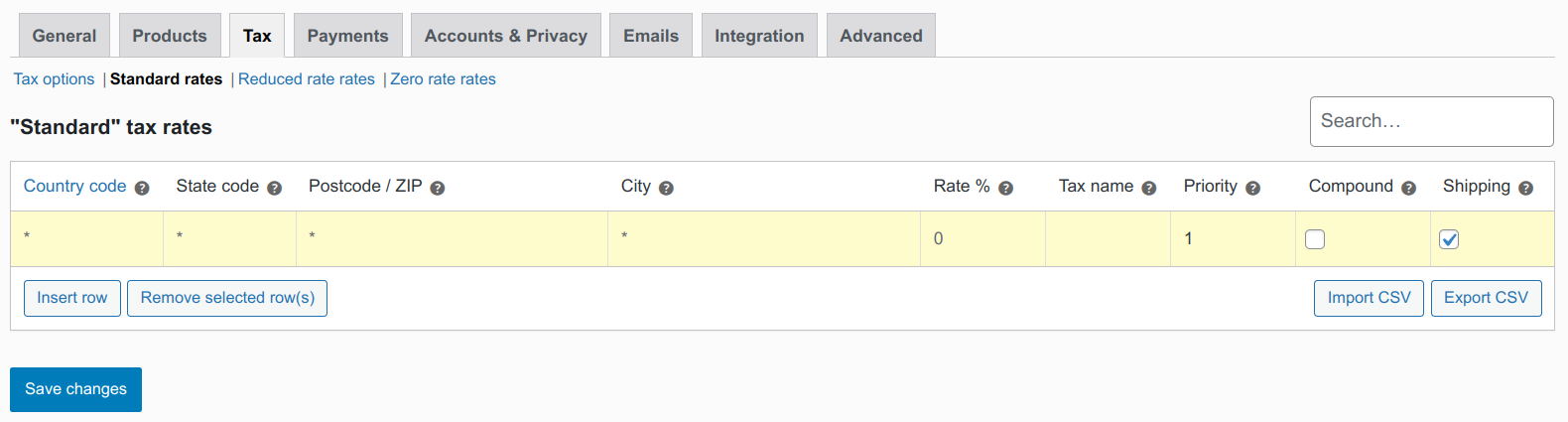

You will be able to configure the following parameters in their respective columns:

- Country code, State code, Postcode / ZIP, City: You can fine-tune the rates for specific countries, states, or postal codes. Leave these columns blank (*), if you want to apply the rate universally.

- Rate: Enter the tax percentage rate.

- Tax name: Provide a clear name for the tax (e.g., “VAT” or “Sales Tax”).

- Priority: Assign a priority level for this tax rate if multiple rates are configured for the same zone. Lower numbers indicate higher priority.

- Compound: Check this box if you want this rate to be applied on top of other tax rates.

- Shipping: This option enables the tax rate to also apply to the shipping cost (if configured).

Don’t forget to click on Save changes when you add or modify rows in the tax rates.

Check out this article from the official WooCommerce documentation for configuration example in different taxing scenarios.